In Australia, industry and government interest in hydrogen is building, as a future major export and pathway to decarbonisation of the global economy. Hydrogen is the most common chemical in the world and has many uses such as fuel for transport or heating, a way to store electricity, or as a raw material in industrial processes.

Hydrogen energy can be stored as a gas and delivered through existing natural gas pipelines and when converted to a liquid or another suitable material, can be transported on trucks and in ships. This means hydrogen can also be exported overseas, effectively making it a tradeable energy commodity.

A number of road maps for the future of hydrogen have been developed at federal and state level such as the CSIRO National Hydrogen Roadmap. The reports find global demand for hydrogen exported from Australia could be over three million tonnes each year by 2040, which could be worth up to $10 billion each year to the economy by that time.

Potential export markets for Australia’s hydrogen include Japan, South Korea and China, collectively known as ‘East Asia’, as well as Singapore and Germany. Japan, in particular, is actively engaged with becoming the world’s first “Hydrogen Society”. Australia and Germany have also just agreed to a study into the feasibility of developing a hydrogen supply chain between them.

Producing hydrogen as an export commodity is not without its challenges. Producing, storing and distributing low cost hydrogen at scale and informing and understanding export value chains and market requirements are just some of the issues to be managed.

The Colour of Hydrogen

Hydrogen, while colourless, can be produced at least through so-called brown or grey, green or blue methods.

The Cost of Hydrogen

Hydrogen production technologies and costs have been estimated in the National Hydrogen Roadmap, representing a base case and 2025 a best case for the net present value of the unit cost of hydrogen over the lifetime of a hydrogen production asset. There is a current cost advantage for blue hydrogen though the best cases for Proton exchange membrane (PEM) and alkaline electrolysis powered by renewable energy (green hydrogen) overlap the blue hydrogen costs by 2025.

| Technology | 2018 (A$/kg H2) |

2025 (A$/kg H2) |

| Proton exchange membrane (PEM) electrolysis | 6.08-7.43 | 2.29-2.79 |

| Alkaline electrolysis | 4.78-5.84 | 2.54-3.10 |

| Steam methane reforming with carbon capture and storage (CCS) | 2.27-2.77 | 1.88-2.30 |

| Black coal gasification with CCS | 2.57-3.14 | 2.02-2.47 |

| Brown coal gasification with CCS | – | 2.14-2.62 |

Patents: An Indicator of Growth and Strategy

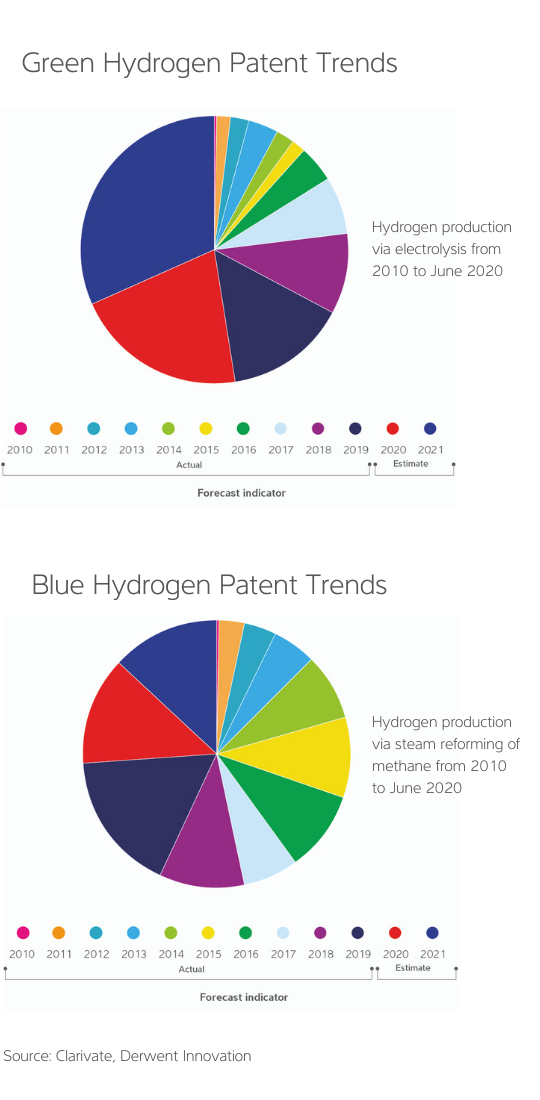

Global patent statistics are showing that both blue and green pathways to hydrogen are capturing increasing industry interest. It should go without saying that industry will not typically spend a significant patent budget on technologies without a future, so patent statistics are a firm indicator of industry strategy.

The statistics show an increasing trend for patent publications targeted at hydrogen production via electrolysis and via steam reforming technologies. Both hydrogen production technologies are in even competition and will remain so at least in the short term despite apparently exponential growth in patent filings relating to hydrogen produced by electrolysis.

The statistics show an increasing trend for patent publications targeted at hydrogen production via electrolysis and via steam reforming technologies. Both hydrogen production technologies are in even competition and will remain so at least in the short term despite apparently exponential growth in patent filings relating to hydrogen produced by electrolysis.

That said, most hydrogen has been industrially produced by steam reforming to date and it is reasonable to expect that this will remain the case until electrolysis costs fall further, which the patent statistics show a drive to achieve.

Given the 20-year lifespan of patents, steam reforming technologies, with carbon capture and storage, will likely remain preferred until the earlier part of 2030-40 given the cost projections provided above. More recent electrolytic technology will more likely encounter the time lag that is common to innovation adoption.

Where is the patent activity occurring?

The statistics are showing a focus on hydrogen innovation for both steam reforming and electrolysis pathways in East Asia, the target export markets for Australia. China and Japan are the largest two filing countries with the United States fitting into third place.

The future of Hydrogen in Australia

The potential of hydrogen is enormous, and Australia is well positioned to seize Green Hydrogen Patent Trends the opportunities of this emerging industry.

Innovations in Australian hydrogen production continue and include the Hazer process which converts methane to solid carbon and hydrogen through a process catalysed by iron oxide and the CSIRO metal membrane technology extracting pure hydrogen from ammonia.

Given the opportunities for hydrogen, it would be a positive to see more, and broader based Australian based innovation because it is Australian feedstocks, including natural gas and water, which have the capacity to grow Australia’s future hydrogen production and export capacity.