The following article provides an update on IP filing trends in New Zealand over the last 4 calendar years, from CY2016 to CY2020.

Interestingly, total patent applications filed by both foreign and local NZ residents have remained largely steady while patent applications filed by only local NZ residents have actually decreased. New Zealand-based appliance company, Fisher & Paykel and Californian-based medical equipment company, ResMed, dominated the patent opposition scene. Trade mark applications have shown a strong increase in filings. Please see below for further information on these trends.

Patents

The total number of New Zealand national phase applications, complete patent applications and provisionals (see Figure 1) has shown some fluctuations over the last 5 years with an average number of 6,252 total patent filings per year over this period. New Zealand filings for the period 2018-2019 showed an increase of 5.7% and a 1.4% drop in filings between 2019 to 2020. There were a total of 6,220 and 6,403 filings in 2016 and 2020 respectively, up by 3%.

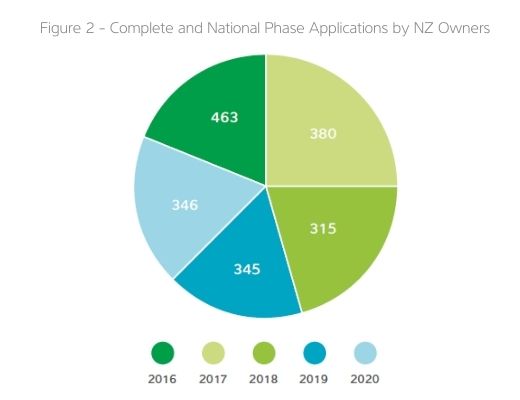

The number of complete and national phase applications filings by New Zealand residents (see Figure 2) shows a decline in filings in 2016, 2017 and 2018 (463, 380 and 315 respectively), with increases in 2019 (345) and 2020 (346).

Trademarks

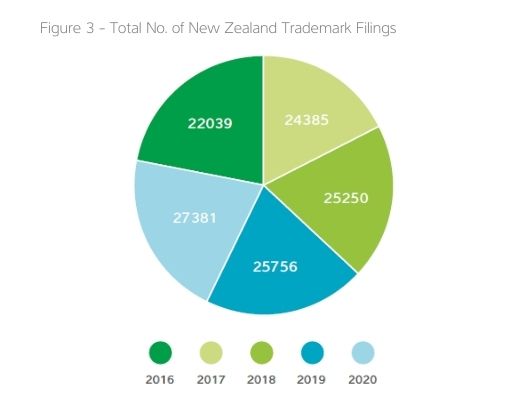

Overall the total number (national and international filings) of New Zealand trademark filings (see Figure 3) have shown strong continued growth over the last 5 years. In fact, when comparing the total number of filings in 2016 and 2020, trademark filings have increased by 24%.

Designs

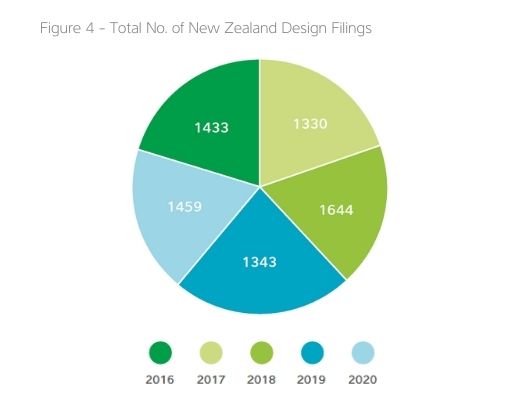

Between 2016 and 2020, the total number of New Zealand design filings has fluctuated, peaking in 2018 with 1,644 filings. Filings dropped in 2019 to 1,343 to an increase of 1,459 filings in 2020. Design filings had an increase of 1.8% in 2020 (1,459) compared to 2016 (1,433).

New Zealand Patent Office Oppositions

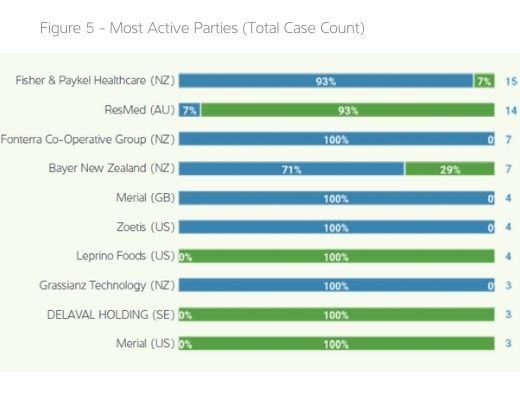

During the period 2016-2020, there were 62 IPONZ opposition actions (see Figure 5) with Fisher & Paykel and ResMed accounting for 47% of all opposition actions.

Data extracted from the New Zealand Intellectual Property Office “Facts and Figures”. Further details can be found here.

This article was prepared by Dr Louisa King, Director of Aperture Insight.

Aperture Insight is a market leader, providing dependable intelligence to its clients locally and globally. Arming them with the best possible knowledge to strategically manage their intellectual property.